Growth stocks have led the stock market for more than 10 years, and Michael Lippert, portfolio manager of Baron Opportunity Fund (BIOPX) , says they'll continue to shine.

The fund has $1.3 billion of assets and invests in growth stocks of all sizes. It has generated annualized returns of 53% over the past 12 months, 3% over the past three years, 19% over the past five years, and 16% over the last 10 years, according to Morningstar.

That beats the Morningstar growth index for all periods except three years.

Lippert looks for companies with outsized growth that can be sustained due to competitive advantages. He’s a long-term investor, seeking to hold stocks for at least four to five years.

Technology, particularly semiconductors and software, is his favorite industry now. He likes e-commerce and electronic payments, among others. The fund even holds a technology-based real estate company.

We recently spoke to Lippert for his thoughts about investing and several of his stock picks. Here’s the conversation.

Baron Funds, TheStreet

Lippert’s investment strategy

TheStreet.com: What’s your investment philosophy?

Lippert: As growth investors, we’re looking where the world is going, not where it’s been. We’re looking at secular trends – what’s driving growth in the economy. We focus on generational shifts like artificial intelligence and the cloud.

We invest in companies we believe will be the leaders, companies with the fastest and most durable growth. They sustain competitive advantages.

It’s companies that turn top-line growth into profits. These are companies that don’t do just one thing but build platforms [with multiple products], like Apple (AAPL) and Alphabet (GOOG) .

We focus on the long term, looking to hold for at least four or five years when we make an investment. We’ve held some of our stocks for more than 20 years.

Related: Veteran fund manager reveals 3 favorite global stocks

TheStreet.com: Which industries and market themes do you like most?

Lippert: Our biggest investments, in absolute terms and relative to the Russell 3000 Growth Index, are in software and semiconductors, stemming from the overarching trend of artificial intelligence.

Before that was the cloud, software as a service and the digital [Internet] world. Underlying all of that is semiconductors.

Our broadest theme is innovation. That includes e-commerce, electronic payments, streaming and health-care segments, such as genomics. Most major trends today involve technology.

TheStreet.com: Which industries are you shying away from?

Lippert: Retail isn’t a big investment for us, though we like Amazon (AMZN) and electric vehicles. Our investments in industrials and [consumer] staples are low.

Those companies lack strong growth. They will grow with the economy, [but that’s not very strong.] We’re looking for parts of the economy that are taking share.

Lippert’s stock picks

TheStreet.com: Can you talk about a few of your favorite stocks?

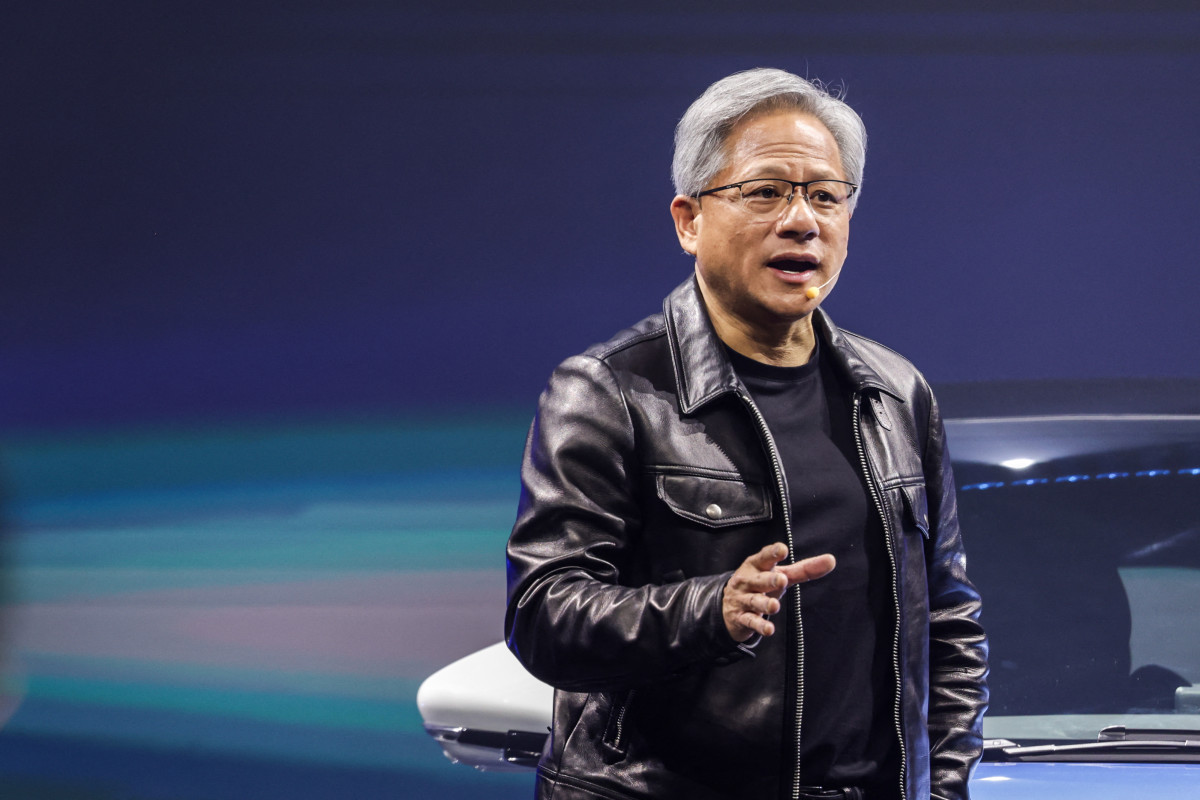

Lippert: Graphic-processing unit chips are what’s behind AI. They can do many applications at once, [unlike previous chips]. The leading vendor is Nvidia (NVDA) . It has seen amazing growth.

Fund manager buys and sells:

- $7 billion fund manager touts 3 blue-chip stocks

- Cathie Wood buys $35 million of beaten-down tech stock

- Single Best Trade: Fund manager at $7 billion firm unveils favorite pick

That’s our No. 1 holding relative to the Russell 3000 Growth Index and No. 2 in absolute terms after Microsoft (MSFT) .

We also think Advanced Micro Devices (AMD) will be the No. 2 player serving a wide range of uses, after Nvidia. And we think Broadcom (AVGO) will be No. 1 among customized players.

Our second largest overweight holding relative to the index is CoStar (CSGP) , the commercial real estate information service. We’ve owned it for over 20 years. Its key differentiator is its data.

It’s the poster child for having multiple acts. It started by putting its information on CDs, then the internet and now the cloud.

CoStar’s latest act is residential real estate, taking on players like Zillow (ZG) . That could be a billion-dollar business.

CoStar’s Homes.com is well-positioned to benefit from the new rules concerning brokers’ commissions. Competitors Realtor.com and Zillow will be hurt.

Finally, we still believe in media. That’s digital media, such as streaming and podcasts. We have significant investments in Meta Platforms (META) and Spotify Technology (SPOT) .

They have great user experiences. Spotify benefits from subscriptions, and Meta is No. 2 in digital advertising after Alphabet.

They both will benefit from AI, which will help them know what content to serve to users. They can personalize it.

That could enable Spotify to raise its prices. It’s very cheap now on a per-minute basis. And AI should provide advertising opportunities for Meta. The more content they show that’s relevant to individual consumers, the more value there is to the user.

Related: Veteran fund manager picks favorite stocks for 2024