/NVIDIA%20Corp%20logo%20on%20phone%20and%20AI%20chip-by%20Below%20the%20Sky%20via%20Shutterstock.jpg)

In a recent segment with CNBC, Wedbush analyst Dan Ives named Tesla (TSLA) and Nvidia (NVDA) as the top physical artificial intelligence (AI) plays in the world. In fact, Ives referred to Nvidia as the "Godfather of AI," claiming that no other firm comes close to its dominance in the AI ecosystem. The latest tech selloff has also hurt NVDA stock. This pullback could be a terrific opportunity to buy this outstanding AI stock at a discount.

Ives Calls Nvidia “The Backbone of the Compute Layer”

During the interview, Ives stated that Nvidia is the “backbone of the compute layer,” mainly referring to its ecosystem strength. CUDA, its software acceleration platform built over two decades, continues to extend the life and performance of its GPUs. Even A100 GPUs shipped six years ago remain fully utilized today thanks to software stack improvements. Ives assessment of Nvidia is not wrong, as the company continues to report explosive growth across data centers, AI infrastructure, networking, and emerging “physical AI” markets.

In the third quarter of fiscal 2026, Nvidia’s revenue grew 62% year-over-year (YoY). Data Center revenue reached $51 billion, up 66% YoY, driven by massive demand for AI compute infrastructure. Compute sales increased 56% YoY, driven by the introduction of GB300 systems, while networking revenue more than doubled as NVLink, Spectrum-X Ethernet, and Quantum-X InfiniBand adoption surged.

The Blackwell platform continues to gain traction. In Q3, GB300 exceeded GB200, accounting for almost two-thirds of overall Blackwell sales. Additionally, the Hopper platform generated $2 billion in revenue. Looking ahead, the Rubin platform is scheduled to launch in the second half of 2026 and is predicted to provide another considerable performance boost over Blackwell. Management estimates $0.5 trillion in Blackwell and Rubin revenue from the start of calendar year 2025 to the end of calendar year 2026. Nvidia also believes it is well-positioned to grab a significant portion of the expected $3 trillion to $4 trillion annual AI infrastructure buildout by the end of the decade.

Nvidia will report its Q4 and full fiscal 2026 results on February 25. For Q4, the company’s revenue projections of $65 billion (plus or minus 2%) align with consensus estimates. This would mark a YoY increase of 65.4%. Analysts expect earnings of $1.53 per share, an increase of 72% over Q4 fiscal 2025.

Ives also mentioned that he feels Nvidia is one of the finest physical AI picks in the world, along with Tesla. Even Nvidia believes that, beyond data centers, physical AI is already a multibillion-dollar market with a multitrillion-dollar promise. From digital twin factories to robotics platforms, Nvidia is marketing itself not only as a chipmaker but also as the infrastructure layer for real-world AI.

The Key Takeaway

There is a growing debate over whether AI enthusiasm created a bubble. However, Nvidia's CEO Jensen Huang and analysts such as Ives believe that Nvidia sits at the center of AI structural computing shifts that are still in their early innings.

Analysts predict a strong end to fiscal 2026 with a 63.7% increase in revenue to $213.6 billion, alongside 56.7% growth in earnings to $4.69 per share. Revenue and earnings are further expected to increase by 53.2% and 65.6% in fiscal 2027. Trading at 24 times forward 2027 earnings, NVDA stock is still a reasonable buy. If Nvidia truly is the "Godfather of AI," as Ives claims, it will continue to shape the infrastructure for the next generation of AI computing. This is most likely why Nvidia still remains an exceptional stock to buy and hold for decades to come.

And Wall Street Agrees!

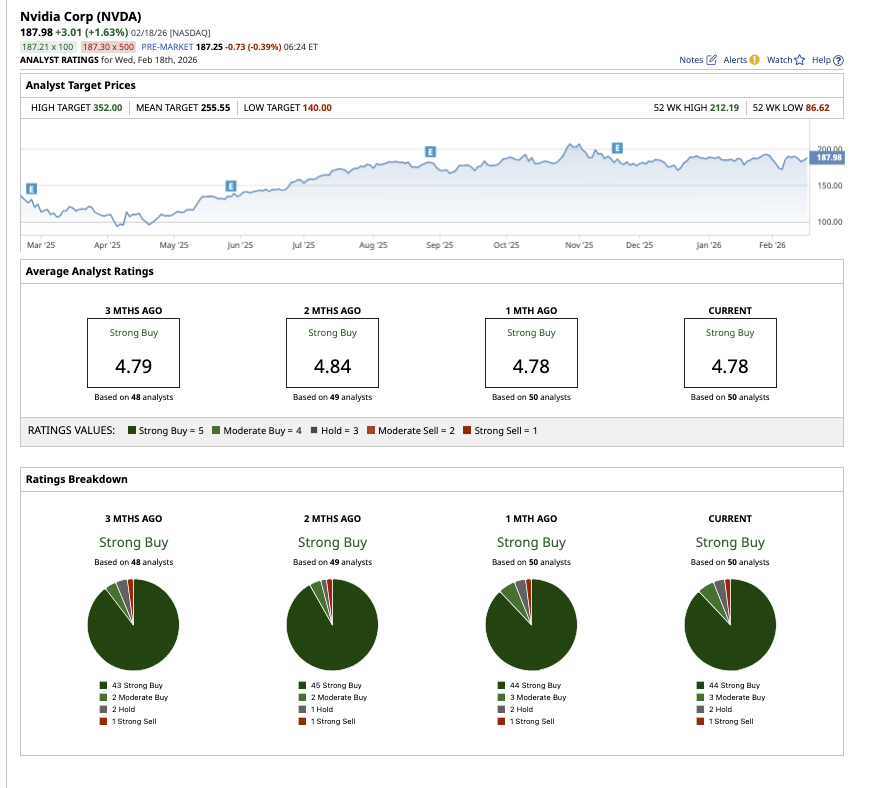

Overall, analysts rate NVDA stock a “Strong Buy.” Of the 50 analysts covering the stock, 44 rate it a “Strong Buy,” three say it is a “Moderate Buy,” two rate it a “Hold,” and one says it is a “Strong Sell.” The average target price of $255.55 implies NVDA stock can rally as much as 36% from current levels. The high price estimate of $352 suggests the stock can climb 87% over the next 12 months.

.jpg?w=600)